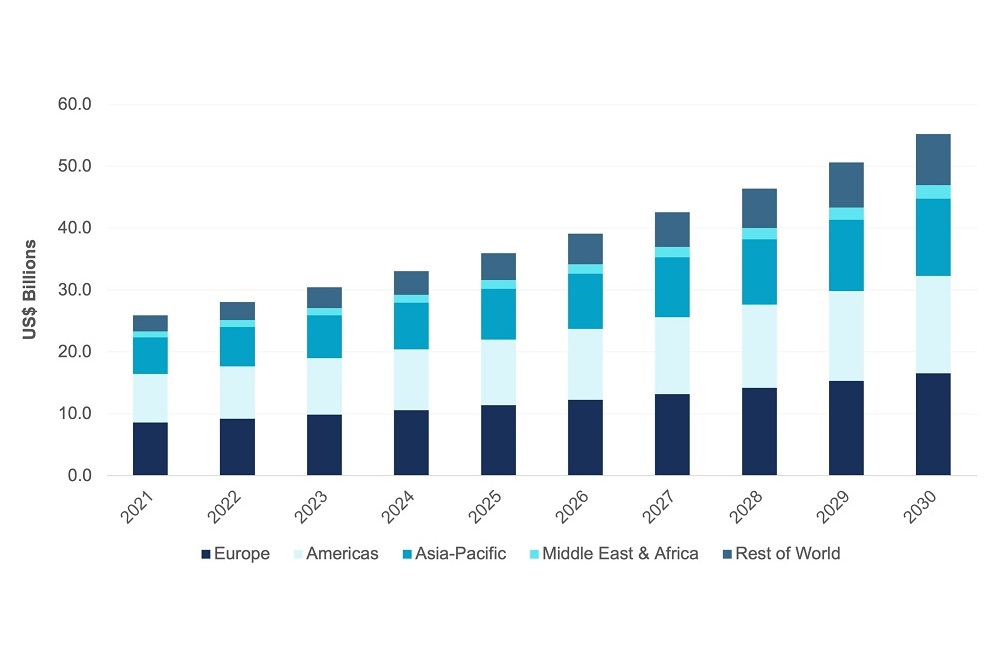

Figure 1: Global Digital Water Forecast by Region, 2021-2030 (Image Courtesy: Bluefield Research)

While the opportunities abound, the addressable market for digital water varies significantly by country and region.

By Eric Bindler, Senior Research Director, Bluefield Research

The digital water revolution is here. The global water sector is being transformed by a wave of new technologies for connectivity, mobility, automation, and data analytics. In every region of the world, proactive utilities are turning to digital solutions to better serve customers and stakeholders, maximise operational performance and efficiency, and safeguard assets and natural resources.

When we talk about the digital transformation of the water industry, the focus often turns to advanced economies in North America, Europe, and Asia-Pacific. And not without reason—countries such as the United States, the United Kingdom, and Australia account for the lion’s share of companies, project implementations, M&A deals, and venture investments.

But as competition continues to heat up in the digital water sector, leading hardware, software, and service providers are increasingly seeking greener pastures, turning their attention to emerging pockets of opportunity across Latin America, Asia-Pacific, the Middle East, and Africa. Different types of solutions, business models appropriate for different types of utilities based on location, size, income level, and digital maturity.

According to Bluefield’s global digital water forecast 2022-2030, emerging and developing markets will account for roughly 30% of the USD 387.5 billion in total global digital water spend expected over the next decade. What’s more, digital water expenditure in emerging markets is projected to scale at an annual rate of 11.4%, compared to 7.7% for advanced economies.

While larger, more progressive utilities in the advanced economies of North America and Europe increasingly turn to cutting-edge digital solutions such as artificial intelligence, predictive analytics, and digital twins, utilities in emerging markets are at much earlier stages of their digital water journeys, which in turn, is creating vast opportunities for long-term market expansion.

What is driving this growth, and where are the opportunities for digital water technology and service providers? Here are some specific market examples:

IN ASIA, AN URBAN EXPLOSION FROM RAPID POPULATION GROWTH IS SPURRING GREENFIELD WATER INFRASTRUCTURE BUILDOUT, ENABLING TECHNOLOGY LEAPFROGGING

The Asia-Pacific region’s move toward digital water is led by smaller countries, with major markets still implementing basic technologies at low price points. Australia and Singapore are regional standouts, with highly innovative local utility cultures, and strong environmental and regulatory incentives to invest in advanced digital solutions.

Meanwhile, emerging and developing markets such as India are facing pressure to meet Sustainable Development Goal targets for water and sanitation access for their fast-growing and increasingly urban populations. This, in turn, creates opportunities for technology leapfrogging, with smart metering, remote monitoring, and SCADA capabilities embedded at the outset as part of new 24X7 water supply networks and greenfield smart city initiatives. According to Bluefield’s forecasts, India’s digital water market will grow at over 10% CAGR over the course of this decade, driven in large part by basic metering, telemetry, and SCADA investments made alongside new treatment and conveyance systems and greenfield smart city initiatives.

Overall, Asia-Pacific holds significant digital water potential, but most markets are in early stages of adoption, with utilities still trialling technologies to determine business case and return on investment. In China, large urban utilities are making initial investments in core hardware and software solutions like meters, billing and customer management systems, and asset management platforms, creating new opportunities for growth in technology segments that have become more saturated and mature in other parts of the world. Low local labour costs in the region results in reduced competitiveness for value-added analytics platforms, as larger utilities can afford to hire internal data analysts to perform their own analysis.

IN THE MIDDLE EAST AND AFRICA, CENTRALISED GULF UTILITIES ARE SETTING THE INNOVATION AGENDA

The water market in the Middle East is highly consolidated and centralised, leading to greater investment in holistic infrastructure and resource management. In the Gulf states, for example, water is managed by large national multi-utilities (e.g., Dubai Electricity & Water Authority, Qatar General Electricity & Water Corp.), enabling water operations to enjoy the spill-over benefits of investment in cutting-edge customer service, remote monitoring, and asset management platforms, which are driven principally by the electric side of the business.

Water stress in the region is also impacting digital water adoption strategies. The Middle East region is investing in improved water management in the face of growing resource scarcity, led by Israel and Gulf State multi-utilities. A heavy reliance on desalination and wastewater reuse in the region results in increased focus on digitalisation at the plant level, while integrated smart city initiatives, such as those in Dubai and Saudi Arabia, are creating showcase project opportunities to educate the regional market. Israel is a key regional leader with a water-centric approach to policymaking, an institutionalised innovation culture at national utility Mekorot, and a robust digital water start-up scene supporting solutions development and deployment.

Water conservation and supply diversification are key priorities for the region, but the highly subsidised water and wastewater sector reduces incentives for operational improvements, often creating reliance on new infrastructure spend over optimisation of existing assets.

IN LATIN AMERICA, PRIVATE PARTICIPATION IS OPENING THE DOOR TO INNOVATION AND DIGITALISATION

The water market landscape in Latin America is dominated by large, regional public and private utilities, investing in basic monitoring capabilities to manage vast networks of customers and remote assets. Utility consolidation and private participation in select Latin American markets is opening the door to greater investment in digital technology, though the region’s complex political-economic environment creates long lead times for projects.

In select Latin American markets, such as Brazil and Chile, increasing private participation in the water and wastewater sector provides an avenue for greater market maturity, importation of foreign expertise and technology, and a growing emphasis on digitalisation to drive efficiencies. The Chilean water industry, for instance, is dominated by large, regional utilities backed by both local and foreign private capital, investing in remote monitoring capabilities to better manage their vast networks of customers and assets.

At a regional level, the priority remains expanding basic water and wastewater service to meet Sustainable Development Goals, with adoption of digital technology in early stages, largely limited to core hardware and software in major urban centres.

Looking forward, there are a number of key macroeconomic, political, technological, and environmental developments which could accelerate or impede digital water market growth in emerging and developing economies around the world – major infrastructure funding initiatives, a ramping up of investments in sustainability and resilience, and widespread energy, food, and debt crises spurred by the COVID-19 crisis and Russia/Ukraine war. Bluefield will be watching market indicators from regulatory and funding shifts to emerging technologies and business models to evaluate new and emerging digital water market opportunities across the globe.

ABOUT THE AUTHOR

Eric Bindler is Senior Research Director for Bluefield Research, overseeing Bluefield’s digital water and municipal water research services. His areas of expertise include digital water technology, company strategy, water finance and investment, and water and climate policy. He is also an active contributor to the Smart Water Networks Forum (SWAN), and was recently selected for a three-year term on the SWAN Council following a successful tenure leading the SWAN Americas Alliance Research Group.

To know more about the author, kindly write to us at info@thewaterdigest.com

Click here to read the complete issue of Digest Magazine XVI-IV.